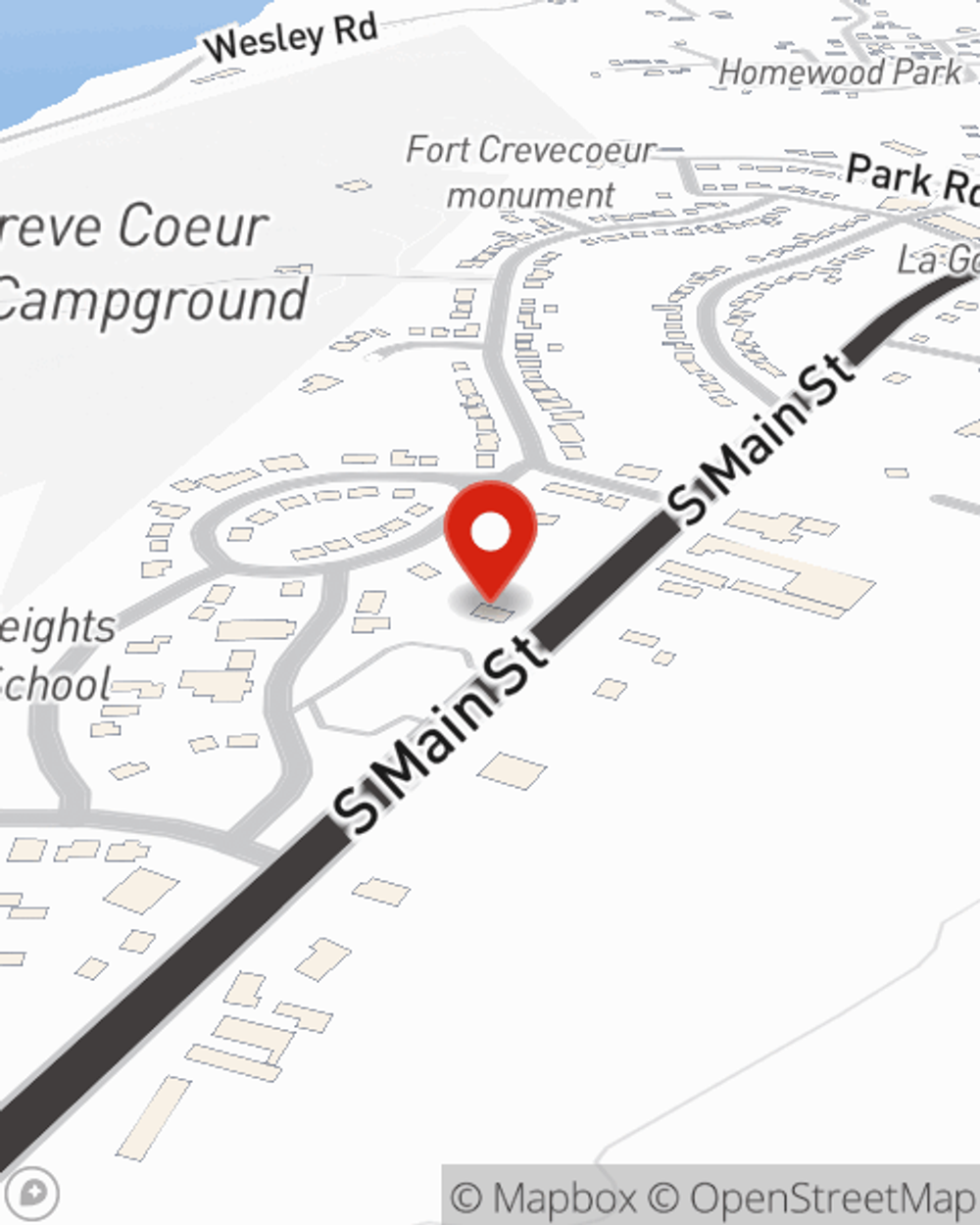

Business Insurance in and around Creve Coeur

Calling all small business owners of Creve Coeur!

This small business insurance is not risky

Your Search For Excellent Small Business Insurance Ends Now.

Owning a business is a 24/7 commitment. You want to make sure your business and everyone connected to it are covered in the event of some unexpected trouble or loss. And you also want to care for any staff and customers who get hurt on your property.

Calling all small business owners of Creve Coeur!

This small business insurance is not risky

Cover Your Business Assets

With State Farm small business insurance, you can give yourself more protection! State Farm agent Rich Dierker is ready to help you handle the unexpected with reliable coverage for all your business insurance needs. Such individual service is what sets State Farm apart from other business insurance providers. And it won’t stop once your policy is signed. If the unexpected happens, Rich Dierker can help you file your claim. Keep your business protected and growing strong with State Farm!

Take the next step of preparation and call or email State Farm agent Rich Dierker's team. They're happy to help you identify the options that may be right for you and your small business!

Simple Insights®

The landlord's guide to the eviction process

The landlord's guide to the eviction process

Evictions can be a lengthy, daunting process for landlords and tenants, so it’s important for you to be aware of the specific reasons, procedures and costs.

Consider a Simplified Employee Pension plan for your small business

Consider a Simplified Employee Pension plan for your small business

Simplified Employee Pension IRA (SEP IRA) plans are employee IRAs funded by tax-deductible contributions from small business employers.

Rich Dierker

State Farm® Insurance AgentSimple Insights®

The landlord's guide to the eviction process

The landlord's guide to the eviction process

Evictions can be a lengthy, daunting process for landlords and tenants, so it’s important for you to be aware of the specific reasons, procedures and costs.

Consider a Simplified Employee Pension plan for your small business

Consider a Simplified Employee Pension plan for your small business

Simplified Employee Pension IRA (SEP IRA) plans are employee IRAs funded by tax-deductible contributions from small business employers.